Somewhat Favorable Press Coverage Somewhat Unlikely to Affect Timken (NYSE:TKR) Share Price

22 Jun,2018

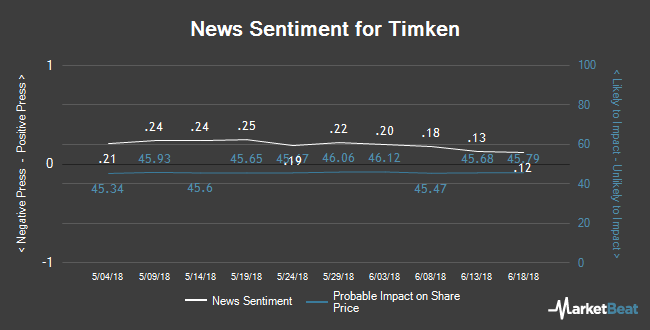

News coverage about Timken (NYSE:TKR) has trended somewhat positive this week, Accern reports. The research group scores the sentiment of media coverage by reviewing more than twenty million blog and news sources in real-time. Accern ranks coverage of public companies on a scale of negative one to one, with scores closest to one being the most favorable. Timken earned a news sentiment score of 0.22 on Accern’s scale. Accern also gave media stories about the industrial products company an impact score of 46.0561732751659 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the company’s share price in the near term.

These are some of the media stories that may have impacted Accern Sentiment’s analysis:

TKR has been the subject of several research reports. Bank of America boosted their price target on Timken from $50.00 to $51.00 and gave the stock an “underperform” rating in a research report on Tuesday, May 22nd. Stifel Nicolaus raised Timken from a “hold” rating to a “buy” rating and boosted their price objective for the stock from $52.00 to $60.00 in a research note on Monday, May 28th. Vertical Research raised Timken from a “hold” rating to a “buy” rating in a research note on Friday, May 4th. Zacks Investment Research raised Timken from a “hold” rating to a “buy” rating and set a $51.00 price objective on the stock in a research note on Saturday, March 24th. Finally, ValuEngine lowered Timken from a “hold” rating to a “sell” rating in a research note on Wednesday, May 2nd. Three equities research analysts have rated the stock with a sell rating and six have issued a buy rating to the stock. The company presently has an average rating of “Hold” and an average price target of $52.60.

NYSE TKR traded down $0.05 on Wednesday, reaching $46.05. 1,295,000 shares of the company were exchanged, compared to its average volume of 790,453. The firm has a market capitalization of $3.70 billion, a P/E ratio of 17.51, a price-to-earnings-growth ratio of 1.35 and a beta of 1.51. The company has a debt-to-equity ratio of 0.58, a quick ratio of 1.24 and a current ratio of 2.34. Timken has a fifty-two week low of $41.85 and a fifty-two week high of $55.65.

Timken (NYSE:TKR) last announced its quarterly earnings results on Tuesday, May 1st. The industrial products company reported $1.01 EPS for the quarter, beating the Thomson Reuters’ consensus estimate of $0.84 by $0.17. Timken had a return on equity of 16.55% and a net margin of 7.71%. The business had revenue of $883.00 million for the quarter, compared to analyst estimates of $836.56 million. During the same quarter in the prior year, the company posted $0.55 EPS. The company’s quarterly revenue was up 25.4% on a year-over-year basis. sell-side analysts forecast that Timken will post 3.97 EPS for the current year.

The firm also recently declared a quarterly dividend, which was paid on Monday, June 4th. Stockholders of record on Friday, May 18th were paid a $0.28 dividend. This represents a $1.12 annualized dividend and a dividend yield of 2.43%. The ex-dividend date was Thursday, May 17th. This is a positive change from Timken’s previous quarterly dividend of $0.27. Timken’s dividend payout ratio is 42.59%.